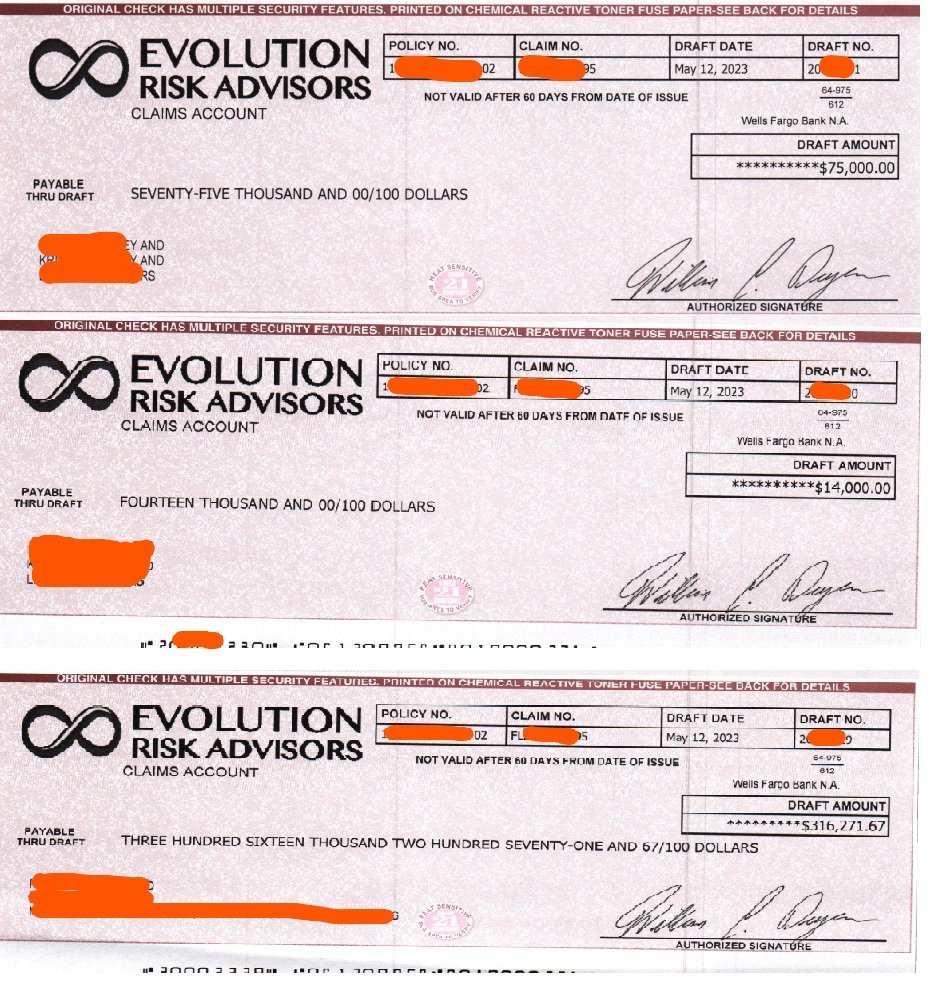

When an enormous oak tree fell on a client's home in November 2022, causing catastrophic damage, the initial settlement offer from their insurance company was a mere $13,000. Liberty Adjusters took on this case, transforming the settlement from an insufficient sum to an impressive $405,271.

You might be wondering, HOW!? Here we’ll get into all the details of public adjusting, breaking down why initial claims can be significantly undervalued and how a public adjuster can dramatically change the outcome of your settlement.

Considering hiring a public adjuster for your claim? Don’t wait, you always get more if you call the public adjuster before filing your claim. Give our team a call today!

The Role of Public Adjusters

Public adjusters play a pivotal role in the insurance claim process, representing policyholders to ensure they receive the maximum settlement for their damages. Unlike insurance company adjusters, who aim to minimize the payout, public adjusters work exclusively for the policyholder.

When a claim is initially undervalued, it's often due to the insurance company's oversight or underestimation of the extent of damage. Public adjusters, with our expertise, conduct thorough inspections, identifying damages that policyholders might overlook. We compile detailed reports that justify the need for a higher settlement, based on the true cost of repairs and replacements.

Why Claims Are Undervalued

Insurance claims can be undervalued for various reasons, including incomplete assessments by insurance company adjusters or a lack of understanding of the policy's coverage.

In many cases, initial evaluations do not account for hidden damages or the full extent of the impact on the property's value. Additionally, insurance companies may apply depreciation values inaccurately or overlook costs associated with bringing a property up to current building codes.

We counter these issues by leveraging our expertise to conduct comprehensive evaluations and by using sophisticated software to accurately estimate repair costs. Their objective assessments ensure that all damages are accounted for, including those that are not immediately visible.

The Process of Maximizing a Claim

The process of maximizing a claim involves meticulous documentation, expert negotiation, and a strategic approach to dealing with insurance companies. We start by reviewing the policy in detail to understand coverage limits and exclusions. Our team then gathers evidence of the damages, including photos, repair estimates, and expert testimonials.

Negotiation is a critical phase where public adjusters like us use compiled evidence and knowledge of insurance law to challenge undervalued settlements. Through persistence and skilled negotiation, they can secure settlements that truly reflect the cost of making the policyholder whole again.

Challenges and How to Overcome Them

Navigating the claims process can be fraught with challenges, from deciphering complex insurance jargon to negotiating with seasoned insurance company adjusters. Policyholders may find themselves overwhelmed by the requirements for documentation and proof of loss.

Public adjusters alleviate these burdens by managing the entire claims process on behalf of the policyholder. They understand the tactics insurance companies use to reduce payouts and are adept at overcoming these obstacles.

By advocating strongly for clients, our public adjusters ensure that the policyholders' rights are protected throughout the process.

The Impact of a Public Adjuster

A public claims adjuster, like us here at Liberty Adjusters, not only ensures that your claim is properly valued but also speeds up the process, reducing the stress and uncertainty that often accompanies insurance claims. With our support, policyholders can achieve settlements that truly reflect the damages incurred, enabling them to repair and rebuild without compromise.

Why You Should Always Call a Public Adjuster

Hiring a public loss adjuster can be a game-changer in managing your insurance claim. We bring expertise, support, and peace of mind to a process that can otherwise be intimidating and complex.

If you're facing an insurance claim, consider the benefits of having an experienced advocate on your side to ensure you receive the maximum possible settlement.

Lean on Liberty Insurance Adjusters today. We can help you navigate your claim successfully.